I hear this all the time: “I wish I’d bought {pick a stock} then. How did I miss this? I’d be stupidly wealthy today. And even when I don’t hear it, I know folks are thinking this. Just as often, they are thinking that their advisor knew or should have known.

This hit my inbox the other day, so I know you’ve seen it/heard it/feel it.

Here is five years of Amazon history.

You doubled your money in five years, and possibly did better depending on the timing of your purchase (and sale!):

But most of you would not have had an emotionally desirable experience (and likely wouldn’t have made it through five years - just look at the volume statistics).

It went from roughly $100 to about $185 in a two-year period.

Then it “tanked” to $84 in one year.

And has since been on a steady upward trend to $194, at least at the moment.

This is awesome, as an undiversified investment, if you:

Have the patience not to trade when you are ecstatically happy (and therefore buy more at the top), or sell when you are devastated (at the bottom).

Recognize that no one can time the bottom or the top. If you do that you were really lucky.

Have the cash reserves to keep you going.

Here is Microsoft:

$137 to $343 to $221 to $450.

Apple? Much more palatable…

Eli Lilly, like Apple, behaviorally, much more palatable. No NVDA, to be sure, but still, pretty, pretty good.

If any investor could predict these performances and consistently make trades like these, they would. I do not think they will be selling you their trading system - they would make way more money on the trades.

Am I In This Jungle?

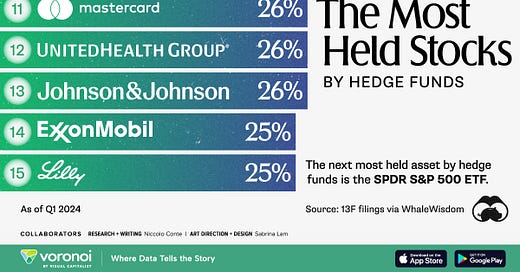

Let’s get back to your FOMO. If you are a diversified investor, chances are quite good (100%, in this case) that the hedge funds represented above own exactly what you own, albeit likely in different proportions. You might not understand that you own these stocks. But you do. Where? Why, your S&P 500 index fund or your direct-index, large cap separately-managed account. If the fund you own is cap-weighted, as most S&P and direct-index funds are, you are factor investing, using the momentum factor, as well. As the capitalization of a given stock increases (hello, NVDA), so does its proportion within your fund. You think that ETF or mutual fund is passive? No, ma’am, it is not. You may be passive in the sense that you buy and hold a set of funds, and at the same time the funds are adjusting their holdings, and at times adding and deleting holdings through buying and selling reasonably frequently and at times significantly. As a side note, this is why mutual funds that you hold might hit you with taxable gains and/or losses, even though you did not sell a single share of that fund during the year (the ETF structure, for the most part, avoids this).

Your investment strategy is just as sophisticated as theirs, and while you may not reap the returns of the Masters of the Universe during this period of rapid rise, you are also far more diversified: when these stocks fall in value, and the probability is excellent that they will, while you may not have had the upside, you don’t have the downside, either, or need to try and time the market to avoid the downside (almost always a loser’s game, it’s just that you only hear about the winners).

This diversified approach, even if it’s “just” the S&P 500, has worked amazingly well over the years.

That’s 10.1% compounded, doubling your money roughly every 7.1 years. The $10,000 you invested 40 years ago and simply “let sit” is now worth $469,346. Assuming 3% inflation, to maintain $10,000 of purchasing power, your dollars would have needed to grow to $32,620. You would have done just a teensy touch better, as you can see. You feel like $469K is not much after 40 years? Well, let’s invest $10,000 every year for a typical working career of 40 years. You could have $4,547,976. You invested $400,000.

Will that happen in the future? No way to tell. How probable is it? My opinion is it’s highly probable. At any point, in any of these years, the doomers (and many, if not most of our news channels) were saying:

No chance this will continue, event X will spoil this year/next year/the next decade.

Kids these days just don’t want to work.

The war in ____ is going to devastate us.

(Pick your country) is leapfrogging us, we are doomed.

Our debt is destroying our economy.

This week Congress dedicates a new bust of Winston Churchill in the Capitol's Statuary Hall. The sculpture is meant to honor the British statesman's legacy of determination and resolve.

It's also a salute to Churchill's friendship with the United States — summed up in an oft-quoted line that Maine Sen. Angus King used during the recent congressional debt-ceiling debate.

As King put it: "Winston Churchill once famously observed that Americans will always do the right thing, only after they have tried everything else."

(editor’s note: this is dated October 28, 2013)

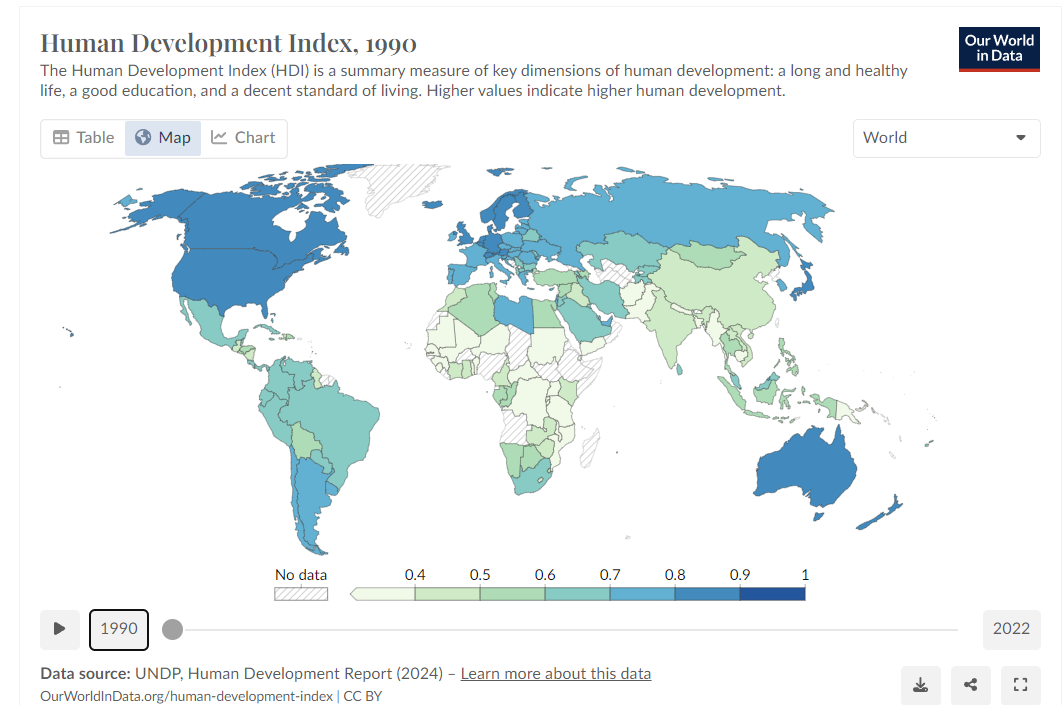

I think we give ourselves too little credit for creatively advancing our society with technology, energy, and legislation. No, we are not perfect. For certain. There is much we can improve, and therein is the opportunity. While the popular press and those who are entranced by it love to tear down our accomplishments and current status, the facts are clear. We are better off than 1990. Globally.

This reinforces my admittedly built-in optimism. Optimism is, for sure, my bias, and accuse me of confirmation bias in my writing. Feel free. That does not change the facts.

So, yes, I think what has worked will work in the future. The counterfactual is not only not pretty, the past results create a large probability that the counterfactual is wrong. You may be persuaded by a different narrative. I’ll go with the large probability over the small one and deal with being wrong if I am indeed wrong.

The large probability:

Takes patience to realize. In investing, it’s called compounding. Don’t interrupt it.

Requires either systematic saving and investing, every week, month, and/or year, or a lump sum sufficient that, with compounding it equals what you likely need in the future.

Rewards diversification amongst investments and sticking with that diversification.

Has a positive view of the future so that you will stick with it.

Benefits greatly from a cash reserve sufficient to carry you through down markets.

The big problem here is behavior. Fear. Panic. Distrust. The inability to leave your money alone and let it work. This is why most people do not achieve market returns.

The Wrap

“Now Mark, you hammer us with the approach that planning is what really matters, and investing, while important, is only one brick in the wall of life and financial success. Yet much of your writing is related to investing.”

This is true, and its driven by your behavior. The great many of you find the planning discussion and process boring and therefore won’t read about this (if you are our client, you know we just do this, we do not ask you if you want us to!). Oftentimes, the only way I can get your attention, and squeeze in the precepts that drive success, is to write about things that get your attention. I may not be as dumb as I look, folks. You did read this.

Maybe this will change your behavior or cause you to be more accepting of the tortoise approach to wealth. I call that successful.

Sundry

A little Taj Mahal is always a good thing

If you are interested in improving your thinking and decision-making, Clear Thinking is the best book I’ve read lately on these topics.