So, the worst, or maybe the best, thing you think could happen has happened. A massive tariff program hits the world from the good ‘ole USA. You’re panicked or exhilarated (I’m hearing more of the former than than the latter, but this is probably the bubble I live in).

Why is the President doing this? Good question. Here is an example of the narratives out there recently, with a hat tip to Epsilon Theory. I do believe it is paywalled and I also think it’s worth reading.

Should you be worried? Maybe. Maybe not.

Have we survived worse? I do believe we have. Will we survive this? I’m guessing yes, but the real answer is maybe.

Does Congress have the power to stop this? They do.

The Congress shall have Power To lay and collect Taxes,

Duties, Imposts and Excises, to pay the Debts and provide for the

common Defence and general Welfare of the United States; but all Duties,

Imposts and Excises shall be uniform throughout the United

States;

Will they take back control of this power? Maybe. If they do, will they change this approach? Probably, since there would be no reason to take control here otherwise.

Protectionism has been tried by many countries. Many are doing it now. It can only work, I believe, if you have sufficient production capability to source all key inputs and produce all key items for your economy from within your country. And it is true that we are far from the only country engaging in protectionist practices. Indeed, some extremely large economies are trying various strategies.

Countries with Notable Protectionist Policies Today (source: ChatGPT):

United States 🇺🇸

Has implemented tariffs on imports from China, the EU, and other countries.

The Inflation Reduction Act (IRA) promotes domestic manufacturing, especially in green energy.

"Buy American" policies favor domestic producers over foreign suppliers.

China 🇨🇳

Uses state subsidies to support key industries like semiconductors and electric vehicles.

Restricts foreign companies from entering certain sectors (e.g., social media, tech).

Imposes regulations that favor local companies over international competitors.

India 🇮🇳

Imposes high tariffs on imports (e.g., electronics, agricultural goods).

Promotes "Make in India" policies to encourage domestic manufacturing.

Restricts foreign direct investment (FDI) in specific sectors like retail and insurance.

Russia 🇷🇺

Has heavily restricted foreign imports and investments, especially since Western sanctions.

Promotes import substitution policies to reduce dependence on foreign goods.

Limits foreign ownership in strategic sectors like energy and media.

Brazil 🇧🇷

Maintains high tariffs on many imported goods, including automobiles and textiles.

Offers subsidies to domestic industries like agriculture.

Complex tax and regulatory barriers discourage foreign competition.

Argentina 🇦🇷

Uses high tariffs and strict import controls to protect local industries.

Restricts access to foreign currency for imports.

Limits foreign ownership in key sectors.

Turkey 🇹🇷

Imposes tariffs on foreign products, particularly in steel and electronics.

Implements nationalist economic policies that favor local businesses.

Restricts foreign companies in industries like banking and energy.

Indonesia 🇮🇩

Enforces local sourcing requirements for foreign companies.

Imposes export bans on raw materials (e.g., nickel) to boost domestic processing.

Has high tariffs on certain imported goods.

Other Countries with Protectionist Tendencies:

Japan 🇯🇵 (non-tariff barriers, especially in agriculture)

South Korea 🇰🇷 (government support for domestic tech industries)

European Union 🇪🇺 (agricultural subsidies, digital market regulations)

The effects of tariffs are well known (also from Epsilon Theory):

The first order effect of tariffs is that they make stuff more expensive and make profitable economic growth more challenging. If there is uncertainty, it concerns whether the direct inflationary effects of tariffs or the deflationary effects of a potential recession win the day.

The U.S. has a long history of protectionism, especially in its early economic development.

Some US Protectionist History

18th-19th Century

High tariffs deployed to protect domestic industries.

Alexander Hamilton promoted tariffs and subsidies in his 1791 Report on Manufactures to help American industry compete against British imports.

The Tariff of 1816 and the Tariff of 1828 (Tariff of Abominations) were designed to shield U.S. industries but caused regional tensions, especially in the South.

Late 19th - Early 20th Century

High tariffs remained a key feature of U.S. trade policy through the McKinley Tariff (1890) and the Smoot-Hawley Tariff (1930)— most economists believe the latter worsened the Great Depression by triggering retaliatory tariffs from other countries.

Shift Toward Free Trade (Mid-20th Century)

After World War II, the U.S. moved toward trade liberalization, promoting the General Agreement on Tariffs and Trade (GATT) in 1947 and later the World Trade Organization (WTO) in 1995.

The U.S. played a major role in reducing global tariffs and signed major trade deals like NAFTA (1994).

Modern Protectionist Trends

While generally pro-free trade, the U.S. has occasionally used protectionist measures:

Trump-era tariffs (2018-2020): Imposed on steel, aluminum, and Chinese imports.

Biden administration (2021-present): Continued some tariffs and promoted “Buy American” policies.

Is all of this necessary? No way to tell. It certainly doesn’t feel good, especially since, by long-used, typical measures, our economy was in excellent shape. Will the announced tariffs achieve the stated, desired outcomes? No way to tell, for two reasons. One is that there are always unintended outcomes and secondary effects. Two is that the stated, desired outcomes have changed several times (see the Epsilon Theory chart above). What we believe is a high probability is that our costs, here in the USA, will go up.

Is our mostly continuous growth in debt, through many Presidents and Party majorities, sustainable? Again, no way to tell. I don’t like it, and I think we need to act on it. Is this set of actions going to fix the debt? Not if the people who study tariffs are correct. Are they correct? Only time will tell.

Now What?

It is easy to say that this too shall pass.

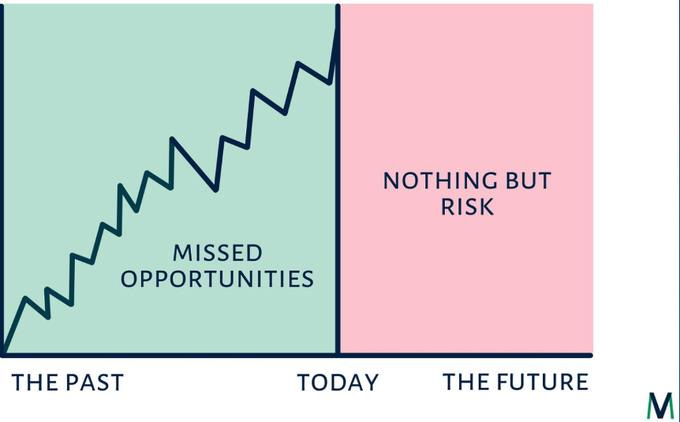

Here’s the problem for you and me - our brains react negatively to uncertainty (chart from Michael Antonelli). Humans, and subsequently markets, see uncertainty as risk and likely negative outcomes.

Historically, that is just not what has happened (the gray bars denote recessions) over the long term.

It is only looking backwards that we see the opportunities.

My advice, whether you think the April 2 announcement is great or awful:

Wait at least 48 hours before even beginning to react.

Recognize that what has worked long term is likely to continue to do so. We have a 30+ trillion dollar economy. It has a lot of flexibility and capacity for error.

Ignore the “news” and pundits. Historically, the Forecasters’ Hall of Fame has had zero members.

Maintain a comfortable cash/emergency reserve. If you can avoid withdrawals in a down market, your “losses” can be turned into temporary reductions in account balances.

Given the history of this President, no policy is likely to be in place for long. Depending on your beliefs, this could be a plus or a minus. I think this will all change, perhaps tonight, perhaps next week. We do not know and cannot know. Worrying about it is wasted energy.

For Deeper Reading

There are numerous academic studies examining the relationship between GDP growth and tariffs. Economists have long debated whether protectionist policies (high tariffs) help or hinder economic growth. Here are some key findings from the literature:

1. Early U.S. Protectionism and Growth

Douglas A. Irwin (2002, 2017) – In his books "Does Trade Reform Promote Economic Growth?" and "Clashing Over Commerce", Irwin analyzes how U.S. tariffs in the 19th and early 20th centuries affected growth. He finds that while tariffs protected certain industries, they did not necessarily accelerate overall economic growth.

Clemens & Williamson (2004) – Their study suggests that in the late 19th century, countries with high tariffs experienced faster growth, but this was in a period when the global economy was more fragmented.

2. Smoot-Hawley Tariff and the Great Depression

Eichengreen & Irwin (2010) – Found that the Smoot-Hawley Tariff Act (1930), which imposed high U.S. tariffs, worsened the Great Depression by reducing global trade.

Madsen (2001) – Showed that global tariff hikes in the 1930s significantly reduced GDP growth by shrinking international trade flows.

3. Post-WWII Trade Liberalization and Growth

Sachs & Warner (1995) – Studied the effects of trade openness and found that countries with lower tariffs and fewer trade restrictions generally experienced higher GDP growth.

Dollar & Kraay (2004) – Found strong evidence that trade liberalization (lower tariffs) led to faster growth, particularly in developing nations.

4. Modern Tariffs (Trump Tariffs, 2018-2020)

Fajgelbaum et al. (2020) – Analyzed the effects of the Trump-era tariffs on U.S. GDP and found that while they helped some industries, they led to higher prices, job losses, and overall economic slowdown.

Bown & Kolb (2020) – Showed that retaliatory tariffs from China and other countries offset any benefits U.S. tariffs may have had.

General Consensus?

Most academic studies suggest that higher tariffs tend to reduce GDP growth in the long run, especially in modern economies where trade is critical. However, in early industrialization, some protectionist policies may have supported domestic industry development.

Thank you for your grounded and expert overview on this Mark. It's appreciated amidst all the frenetic noise and discord.