Into The Great Wide Open

Crypto Or No?

As we have all seen, the performance of some crypto/crypto-like/crypto-adjacent assets has been spectacular. Virtually every human is attracted to the acquisition of significant wealth - it’s that funny relationship between money and the brain. A few people have done this in the crypto world. Many of you, feeling this attraction and maybe seeing a friend experience a big hit, have (or should have!) questions, perhaps like these:

Is this attraction healthy?

Is it probable that the purchase of crypto assets will be beneficial for my wealth?

Should I own some, a bunch, a tiny bit, none?

Is this a passing fad or is it here to stay?

You will find many links in this post. This is a complex topic with many media mentions and large differences in opinion.

Personally, I hold a small portfolio (.06% of my total portfolio - six one-hundredths of one percent): Ether, Solana, and Bitcoin (BTC). Why these three? They were popular at the time I made the purchases (whether they are or turn out to be decent, long-term investments remains indeterminate). Why did I buy them? We have clients who own crypto, or want us to purchase crypto for their accounts, or are crypto-curious. I felt like I needed to experience the market if I am to provide decent advice. I’m not yet certain being an owner has helped, but, hey, I’m trying. Has the value of these three increased in the last year? Yup, 50.9% in the last year and 300% total since my purchase dates in February and October 2022, according to Gemini, which is where I hold these. Solana is the big winner, with a 500% gain since October 2022. Ether is the dog of my personal CrypDow, with a 150% gain. BTC is up 318%. Not bad for three years, huh? Since this is, essentially, a dartboard portfolio, I can only attribute my performance to selection luck and fortunate timing (which is a form of luck). And as the saying goes (and the SEC requires): PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.

If you are not aware of the crypto markets, I might just say bravo for you. Given the amount of media attention and promotion, most likely this means you’re not sentient (if so, I have a question as to how you’re reading this). Since you are aware, and if you’re like me and a whole bunch of other people, you remain unsure regarding the purchase one or more of these assets, this Bud’s for you.

What’s the Story, Morning Glory?

If you want a deep dive into the crypto world, this isn’t it. You can find one here (From Matt Levine, written for Bloomberg). My intent is to have a legitimately lucid look at what it is that you acquire and what you can and cannot expect when you purchase crypto assets. You may have noticed I am being quite careful with the word “investment”, at least as it has historically been used in financial writing. Given the performance data of the last few years, why bother to discuss crypto? Number Go Up, right? Well, yes, that has been true. The $64,000 question, assuming you’re an investor, not a trader, is: Will it be more valuable tomorrow? Tomorrow might be next week, or month, or year, or beyond, depending on your return goals and time horizon, of course. Regardless, you buy it with the intention of selling it for more than you paid. I am extremely fond of saying that the Forecaster’s Hall of Fame has no members. I will not make any attempt to predict your outcome. The answer will be yes if you can find someone tomorrow who is willing to pay more than you paid and no if you cannot. That is, of course, true for every investment. The difference with most crypto assets is there is no other reason to own them - no cashflow, no P&L, no assets, no customers - none of the investment fundamentals that we have used historically to justify investing in one thing or another. I’m not calling this good or bad, I’m simply noting the facts.

Now that we understand the value proposition for many crypto assets (not all, some are used in or for crypto infrastructure and have real cashflows, revenues, customers, etc., just like other businesses), let’s talk about what you do and do not own.

It all started in 2008 with the publishing of a white paper: Bitcoin: A Peer-to-Peer Electronic Cash System. Who wrote it? We don’t know. Well, Satoshi, but we don’t know who he, she, we, they, or it is.

“an electronic payment system based on cryptographic proof instead of trust, allowing any two willing parties to transact directly with each other without the need for a trusted third party.”

Did an electronic payment system get created? Sort of. What’s happened is the process defined in the paper resulted in the manufacture of BTC. The market assigns value to Bitcoins when people buy and sell them. Is there any underlying value? There are people who argue there is, and the arguments (this is not a comprehensive list) sound like this:

You don’t need a bank. You have stateless, unrestricted, uncontrolled access to your funds.

Your transactions are private (this is not entirely true).

It’s a store of value that cannot be manipulated by governments. While “limited supply” is currently true, it can be manipulated (due to “whales”), and currently there are some large holders who may be able to manipulate the price.

Big companies are making it part of their treasury strategy.

There is a fixed supply and increasing demand.

If it’s a combination of everything then its real value proposition is your faith that it has value. This kind of circular thinking tells me that people are creating their own value proposition. That proposition changes based on surrounding conditions. This feels an awful lot like motivated reasoning.

And then there are people who argue that there are no business fundamentals here - this is one, mad, crowd delusion. No P&L, no cashflow, no balance sheet, no customers, no products. Well, yeah. But you can say the same thing about the US dollar (USD). What’s the difference? Aside from long-term usage and cultural acceptance, we have the full faith and credit of the US Government (and other governments for their currencies). We’ve seen this happen in the S&L crisis (where the US Government, through the Resolution Trust Corp, closed 747 savings and loan institutions and made all the depositors whole) and the Great Recession. Real companies like AIG, GM, Goldman Sachs, and Bank of America received USD from the USG.

Can I buy and sell things with Bitcoins? Sometimes, and not often. Most of the time you have to convert your BTC to the national currency of your choice and then use that currency to make your purchase.

What you own is an entry in a database and the right to sell that entry. Might we care who started this? Well, I think so. What were the incentives to publish? How would the person or group or entity who published benefit from this? Why publish anonymously? Why remain anonymous?

Who owns the software that creates Bitcoins? It is “open-source”, maintained and developed by a global community of developers and users. No one is getting license fees or can charge for the use of the Bitcoin generating software. You have to use your own computing power (or rent it) to generate Bitcoin. This process consumes an immense amount of energy. Bitcoin supply is capped by the design at 21 million. Current estimates of unmined BTC range between 1.4 and 2 million. I might speculate that a software/design change agreed to by a majority of the developers could allow for more capacity - that is, increase the potential supply to greater than 21 million.

There is no US Treasury creating and managing the supply of BTC. Some think this is terrific. Those who have been scammed, or had their crypto stolen, maybe not quite so much.

If all this sounds like the some of the same problems we have with fiat currencies (except without any Government regulation or protection) you just might have some company in the thinking room. What problems are we talking about?

Inflation (from printing/creating more currency).

Devaluation.

Potential manipulation of value through supply control.

Value based solely on trust with no underlying assets, cash flow, profits, etc.

What you don’t own:

A right to anything else, including anything that you would expect when you buy a publicly or privately-held equity/stock.

A share of revenues, expenses, profits, and losses.

A portion of the balance sheet (assets of the enterprise).

A share of the cashflow of an enterprise (there is no cashflow, there is no enterprise).

Any shareholder or ownership rights.

Legal protection by regulator.

Consistent, enforceable regulatory framework.

So even if what you bought - Solana for example, can be used to generate net income and cashflow, you, unlike the purchase of CarMax, for example, do not have a right to the net income generated by Solana. Bitcoin does not go that far. The original intent of Bitcoin was to either supplement or replace what we generally accept as currencies, such as the US Dollar, the Swiss Franc, The Chinese Yuan, or the Japanese Yen.

Your Expectations

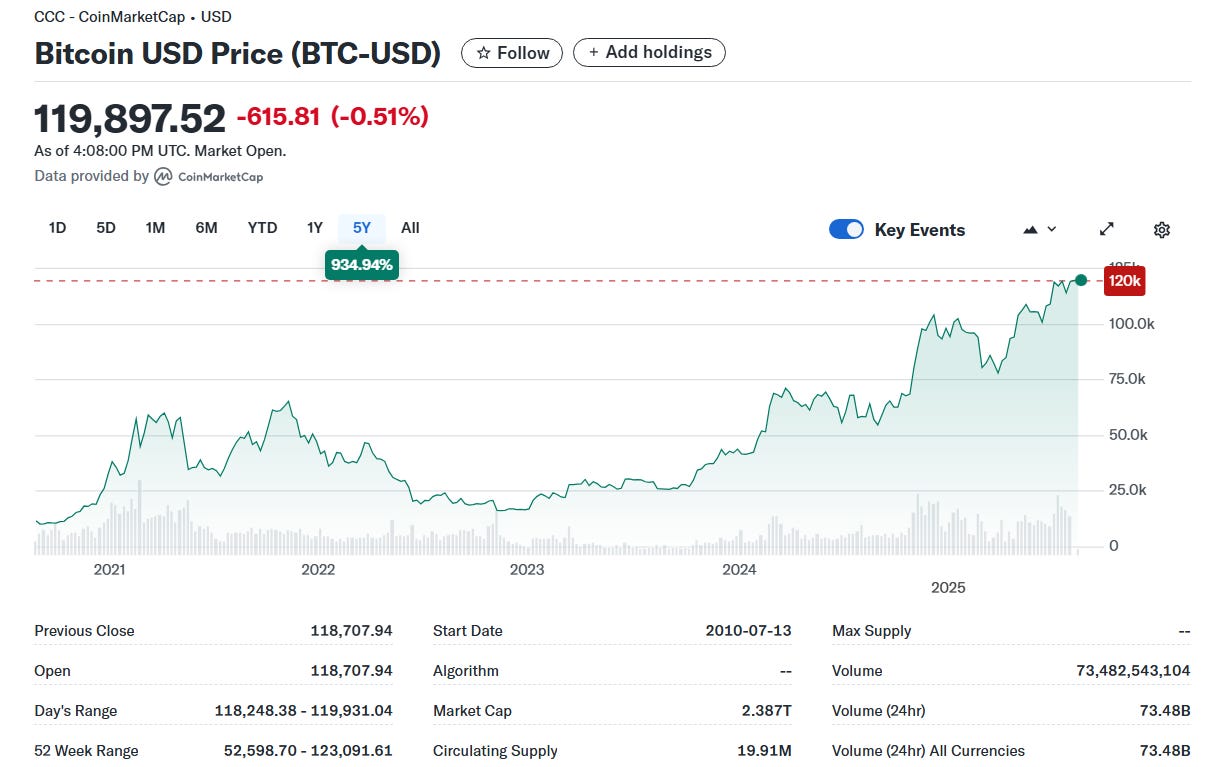

The crypto products, virtually all of them, are highly price volatile. BTC, in the last 52 weeks, saw a per share low of $52,598 and a high of $123,091, marking a $70,493, or 134%, swing from low to high. You absolutely made a knock-out return if you bought it early and held on (the same is true for Amazon, by the way).

Solana’s price ranged from a low of $96 to a high of $294, covering a range of $198 per share or 206%. Like Ether, shown below, depending on your timing you could have experienced terrific returns, essentially no return, or a loss. It’s all timing, folks, just like being a comedian.

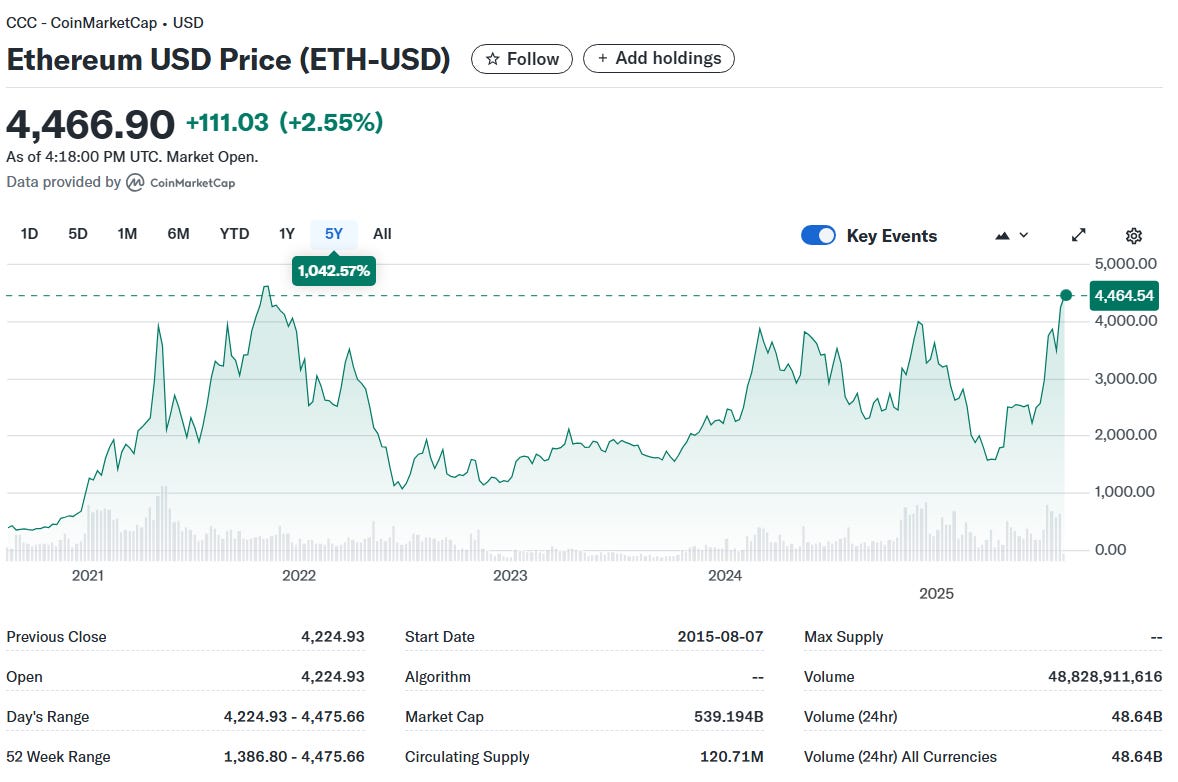

What about Ether? It had a 52 week low of $1,386 and high of $4,475. That’s a spread of $3,089 or 223% from low to high. If you happen to have poor timing, buying it late October of 2021, you have made essentially no return to this date. If you had great timing (and a highly elastic volatility stomach - you would have held it when it plunged from roughly $4,500 to $1,100 or so in about one year, right?) and bought it in late 2020, you have a spectacular return, assuming you sell now or sold in late 2021. You may have experienced a loss, as well.

So what you can and should expect is lots of volatility. You should expect lots of offerings, as there is little to no regulation in these markets. It would be wise to expect significant fraud, as well, such as FTX, TerraUSD/Luna, Safemoon, and the not-so-delightfully named pig-butchering.

Your Planning and Crypto

It is extremely hard to provide advice in this space. Crypto may turn out to be a new class of asset. It’s volatility profile is, from a 20+ year perspective, unknown. Many new assets are emerging. For example, will stablecoins be a real thing and a currency substitute? We do not know. Is the BTC treasury strategy going to work? We do not know. Is Michael Saylor a fool and going to crash, or is he a genius and going to soar? Or maybe both and do an Icarus? No one knows.

The first thing to assess is your tolerance for volatility (price swings). Can you stomach a 90% drop in price? The second thing is loss capacity. If this asset turns out to have zero value, what is the consequence for you? Do you have excess capital? Then there is cashflow. Do you have a need for income? The purpose of answering these questions is to determine how much exposure you could hold. This exposure could be tremendously beneficial. It could be a disaster. We do not know. You could say this about any investment - except that we have 100 years of performance data for most of the other asset classes, substantial experience with the behaviors of most of the equities (and with most bonds you have a legal commitment to return your capital as well as pay interest), and many of these publicly and privately available instruments are protected by well-tested law and regulation.

You may be properly served by zero allocation to these assets. Or you might want and be able to deal with a large allocation. Does anyone know the direction of the price trend? There are those with extreme confidence in the up trend. How can they know? I have no idea. Are they right? Perhaps. Are they wrong? Perhaps. Are these assets “built-to-last?” and is crypto here to stay? Or is this an extraordinary, popular delusion, and the madness of crowds? Could be. Or maybe not. Crypto has lasted longer than most financial professionals expected if you go back ten years or so. I do not know the answer to any of these questions, nor do I believe anyone else does at the moment. Time will tell.

Your Options

There are mutual funds, exchange-traded funds, and individual assets, all of which you can purchase. Virtually every broker-dealer (Schwab, Fidelity, and eTrade, for example) allows you to hold various crypto products. You can talk to your advisor. You can directly own products in a wallet, of which there are many providers. My best advice, should you choose to allocate some funds to crypto, is to diversify. Picking winners and losers, which is hard enough with 100 years of data, consistent accounting and regulation, and open markets, is exponentially more difficult here.

Parting Thought

Before entering into any transaction, crypto or otherwise, it is useful to understand who benefits. How probable is it that you will reap the kinds of rewards the people you read about are reaping or have reaped? This was just published in the Wall Street Journal: Crypto Firm Circle Posts Loss in First Earnings Report After IPO.

The company racked up one-time costs of $424 million related to stock-based compensation and $167 million to account for an increase in the fair value of Circle’s convertible.

Those one-time costs? They are payments to executives (stock-based compensation) and equity holders (the fair value increase in the convertible note) Whether Circle succeeds or fails, those people got their money. It’s worthwhile to consider and understand who benefits.

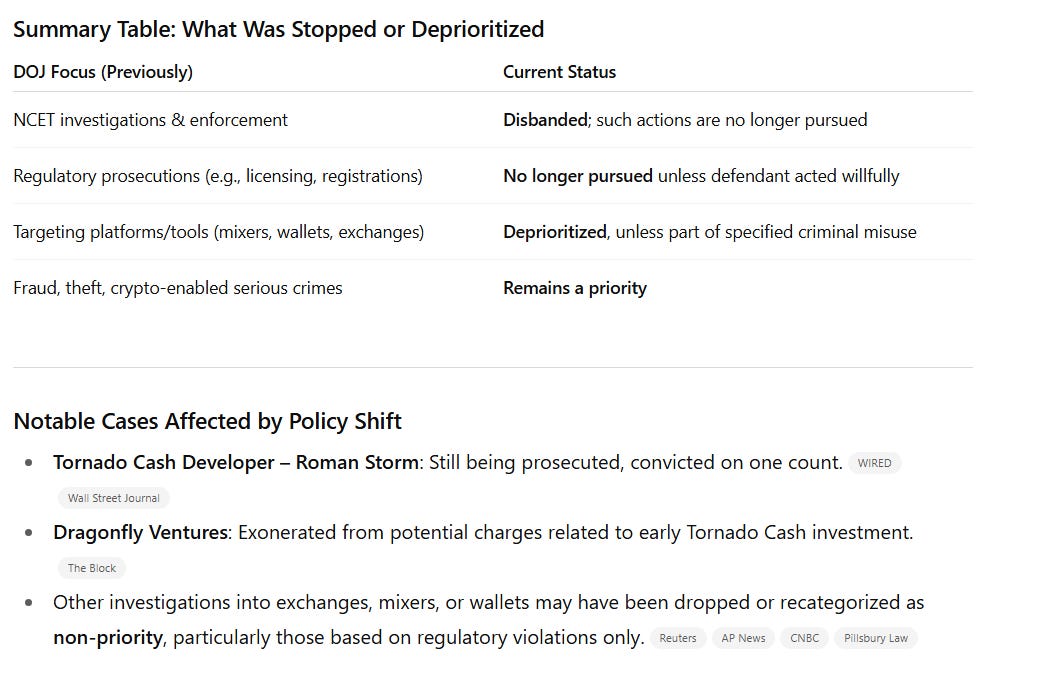

Why is crypto so hot now? One reason is the the family of the US President is prominently promoting crypto (The Recipe Behind the Trump Family’s Crypto Riches: PancakeSwap), another is the Administration is pushing friendly legislation (the Genuis Act), and a third is the Department of Justice has disbanded several enforcement efforts and investigations (Source: ChatGPT).

Combined, these actions are spurring current activity and interest in crypto.

Great stuff Mark. I too, have a tiny Crypto allocation I stare and wonder and mostly do nothing to.