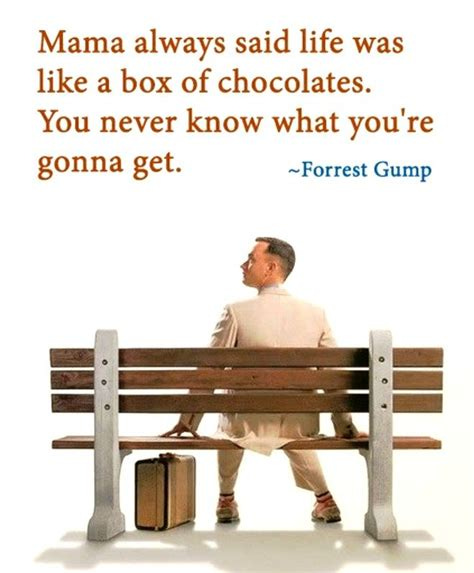

Luck plays an outsized and under-credited role in our lives.

“An escape, a shot in the dark, a legacy: Here is Olympian Lilia Vu”. This fascinating article in The Athletic (yes, it is paywalled) could easily be a fictional story. It certainly seems like it ought to be. What a fantastic series of events! Ms. Vu has worked hard. So did her parents. There is a certain amount of her success that is the result of effort, determination, and grit.

How much of this young woman’s life is due to to those things, and how much to luck? We cannot know.

As a younger man, Dinh entered trade school and became a mechanic. He worked as a contractor for the U.S. Army while war raged through Vietnam in the late 1960s. One day, he repaired a bulldozer belonging to one of Hongyen’s relatives and was deemed “useful” by her family.

How did Dinh happen to be repairing the bulldozer, that day, for these people? Luck. Luck is how Dinh is married (arranged by the families) and builds a family of his own.

Luck is how the married couple decided to flee Vietnam:

So, there they sat, perched forward, looking at that glass. Out of options, Dinh and Hongyen sought the advice of a “coi bói,” or fortune teller. He was named “Mr. Seven” and revered by the locals. Dinh and Hongyen asked the only question on their minds: Should we attempt an escape?

Mr. Seven rolled up a piece of thread until it twined into a ball and told them in Vietnamese, “If it floats, you go. If it sinks, you stay.”

After spending who knows how much time debating this dangerous endeavor, they decide based on whether the thread floats. Now, you could argue that Mr. Seven knew the thread would float and this is a way to tell them to leave without explicitly saying so. Or it could be that in Mr. Seven’s experience, sometimes the thread floats and sometimes it does not. Or maybe he had never done this before and had no idea. How did they even come to know and trust Mr. Seven?

So Dinh goes and builds a 32-foot boat to accommodate his family of about fifty people. He also hand-builds the engine. As you might expect, many many people wanted to go. He has never built a boat.

Eighty-three people packed tightly onto the boat, stuffing supplies underneath them. Dinh powered on the engine, snapping the quiet. The boat jolted, then built speed, heading into the open waters of the South China Sea. Hearing a buzz behind them, the passengers looked back. Two công an (the public security branch of the Vietnam People’s Armed Forces) boats cut through the water, giving chase. Dinh cranked the engine harder.

Having gotten safely away (Why did the police boats turn away? Certainly they could have caught this hand-built boat?), there were two ways this voyage could succeed. One is they are picked up by a ship whereby they can gain asylum in some other country. The other? Crossing 700 miles of the China Sea to reach Singapore. Otherwise, they are captured and returned or they die.

The South China Sea is larger than the area of India. From Subic Bay in the north to the Strait of Malacca in the south, its 1.4 million square miles touch the beaches of Vietnam and Malaysia, of Singapore and Brunei, of the Philippines, Indonesia, China and Taiwan.

The boat starts to sink after two days and three nights on the Sea, halfway to Singapore. They cannot fix the leak. There is a flare gun with one, that is correct, one, flare. Dinh fires the flare. In the middle of this vast sea, the flare is seen by the USS Brewton. Luck. It’s not like they were out there looking for Boat People in order to provide them asylum. Yet they rescue everyone from this sinking boat.

Lilia Vu’s grandparents end up in Orange County, 30 miles south of Los Angeles. One of their children, who adopted the name Yvonne upon entry to the US, marries Douglas Vu. They build a life, including a daughter, Lilia.

Lilia is a 26-year-old professional golfer. A former UCLA star, she’s spent the last five years navigating the highest highs and the lowest lows of the pro game. She has the disposition to match — charming and candid out of the spotlight, quiet and uneasy in it.

The amount of luck in this story is amazing. The boat could have sunk. They could have run into a storm. They could have been caught by the công an. There have been more than a few tsunamis in that area (see the Ring of Fire). Lilia almost quit golf when she was ranked 1,330th in the world. Maybe the golf ball (if you play, you know exactly what I mean) takes a bad bounce in a tournament and she quits.

Instead, Lilia Vu is famous and headed to the Olympics.

I don’t read the New York Times, which owns the Athletic now. I would have never seen this article but for my spouse, who does read the Times and told me about it. If, for whatever reason, she does not tell me about this article, I am not writing this today. If my wife is not in the restaurant’s office the day I went to pick up my paycheck in July 1984, my wife and I never marry.

Luck.

Steve Ballmer is now wealthier than Bill Gates. If Mr. Gates decides to be less philanthropic, if IBM requires a different contract for MS-DOS, or if MSFT performs differently, oh no, Mr. Ballmer is not wealthier. He might have nothing.

Softbank sold its 4.9% stake in NVDA five years ago for $3.3 billion. Today it would be worth something like $160 billion. Like you, no doubt, I am not crying for Softbank, either. But an additional $150 or so billion, in five years? That’s 45 (!!!) times more return on the investment.

So What?

Luck plays a major role in your financial planning. No one expects to die young. It happens. No one intends to become disabled. It happens. Not many people draw up and achieve a life plan to create generational wealth. It happens. When we are designing your financial plan, we have to ponder contingencies.

We cannot be certain how long you will live, nor can we know how healthy or unhealthy you will be.

The rate of inflation, which hugely impacts cost of living, is known only in hindsight.

We do not know how much you will earn.

What will happen to Social Security over time?

Investment rates of return are not predictable.

You may be highly likely to inherit. When?

You don’t expect it and inherit a material amount.

You get a large equity award and it strikes.

Cars are totaled, floods and earthquakes wipe out property, and houses catch fire.

Businesses fail.

"Mann Tracht, Un Gott Lacht". Man plans, God laughs. You don’t have to be religious to feel how true this is. We express this uncertainty in financial planning a number of ways. We run scenarios all the time. Here are some examples:

Dying too soon.

Living too long and needing care.

Becoming sick or injured and unable to work.

Timing of stock option exercises and at various values.

Monte Carlo simulations (note: markets are not perfectly efficient) to create probable ranges of investing outcomes.

Various income levels and career trajectories.

Projections of net worth at various ages.

Stopping work sooner.

Working longer.

One spouse quits working and never returns.

Planning for children (and sometimes for children that were not in the plan!).

Leaving corporate and starting a business.

We have seen multiple clients leave a corporate employer where they were doing quite well and more than quadruple their compensation in less than 5 years. We have seen the opposite. We have clients who have realized multiple millions of dollars in stock option exercises. We have a client’s options go from millions of dollars to hundreds of thousands (Yes, we advised them to sell at much higher prices. Biases can be extremely hard to overcome). One client now has a new role with double the prior year’s compensation.

Hard work? Sure. There is also being in the right (or wrong, unfortunately) place at the right time.

There is always luck.

From “Why Concentrated Stock Positions are a “Loser’s Game”:

“In addition, almost 60% of stocks reduced shareholder wealth. Bessembinder also found that just 4% of stocks produced all of the market’s excess return over Treasury bills. He also found that the 86 top-performing stocks, less than one-third of 1% of the total, collectively accounted for more than half the wealth creation.”

On the investing side, we have always advocated for and most likely will always advocate for diversification. The number of people who can consistently and repeatedly find the one-third of one percent is exceedingly small and there is no way to identify in advance who they are. In estate planning, luck is why you need at minimum a power of attorney (who makes decisions for you if you cannot?) and also, if you own anything, a will (where do your possessions go?). Most of you need personal insurance to deal with the financial risks of dying too soon, living too long, or becoming sick or injured and unable to work. Most of you also need property and casualty insurance to cover the financial risks to your property and to address personal liabilities that could arise. Some of you need errors and omissions and/or directors and officers coverage.

Can some of you self-insure these risks? Yes, and it is not many of you.

We can plan all we want. We can conceive and theorize about lucky and unlucky scenarios. The highest probability is that we will get most of it wrong. Something else will happen. This not to advocate for no planning. It is to advocate for repeated planning and for adapting to what happens, both planned and unplanned. We advocate for maintaining excess cash, whether you want to call it emergency or income reserve. Things happen. And if you cannot stay in the game, you lose.

Because our friend lucky and its companion unlucky are always there.

Sundry

Need some escapist, entertaining reading, and maybe learn some Florida history in the process? Read Carl Hiassen.

I’ve been a fan of Steven Van Zandt for many years. Watch Disciple and you will understand why.

And what would your day be without Ian Hunter?

Absolutely hit the mark when it comes to luck!